Tax research paper. Tax research paper. Step1.Read the ebook.

Step2.research your selected court case:Hempt Brothers, Inc. v U.S. 74-1 USTC

(relates to transfer of property to a corporation )

Use Google and other online research tools. Sometimes it is as easy as putting the court case in as the search term. Read the entire court case. Make notes on when it refers to Internal Revenue Code Sections or even other court cases. Consider reading the other court cases that are mentioned in your selected court case to see if there are similarities or differences. Follow the guidance in Chapter Section 2-2 to see if there are other sources you should use to fully understand your court case.

Step 3 – Now for the creative part. You need to make up facts about an imaginary client of yours. The client is coming to you for tax advice and they provide you with some facts (that you create as well). The facts should be related to the court case you selected but does not have to be exactly the same (sometimes it is better if your facts differ slightly from the facts in the court case selected). Please be creative and detailed in this section so that I can see you understand the main issues in the court case you selected.

Step 4 – Write a Tax File Memorandum. Use exhibit 2.7 in the text book as your guide. The facts, issue and conclusion will be based on your clients tax situation. The analysis section should be based on the details you found in your selected court case and how that information helped you form your conclusion based on your client’s situation. DO NOT just copy sections of the court case in your analysis. You need to show you understand the tax concepts and issues presented in the case and how that impacts your client.

Step 5 – Write a letter to the client. Use Exhibit 2.8 as a guide. Write a letter to a client in such a way that you are able to communicate the information you discovered in your research. The tax file memorandum is a great place to formulate key points – but remember, the client needs to understand it in as basic terms as possible. DO NOT just copy sections from your tax file memorandum. This letter is the "fun" part – make it creative.

P(5)

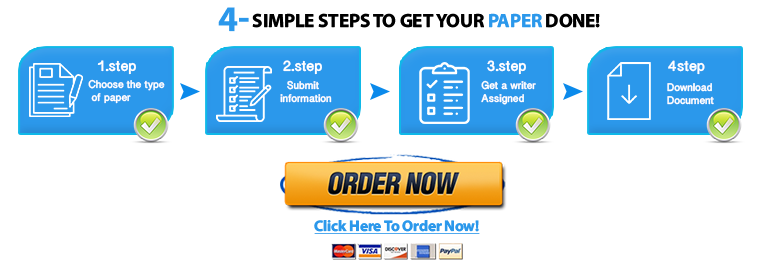

- Among other benefits, we guarantee:

-

Essays written from scratch – 100% original,

-

Timely delivery,

-

Competitive prices and excellent quality,

-

24/7 customer support,

-

Priority on customer’s privacy,

-

Unlimited free revisions upon request, and

-

Plagiarism free work.