Beta and risk rankings. Beta and risk rankings. Beta and risk rankings. You are considering stocks A, B, and C for possible inclusion in your investment portfolio. Stock A has a beta of 0.80, stock B has a beta of 1.40, and stock C has a beta of 0.30

a. Rank these stocks from the most risky to the least risky

b. If the return on the market portfolio increased by 12%, what change would you expect in the return for each of the stocks?

c. If the return on the market portfolio decreased by 5%, what change would you expect in the return for each of the stocks?

d. If you believed. that the stock market was getting ready to experience a significant decline, which stock would you probably add to your portfolio? Why?

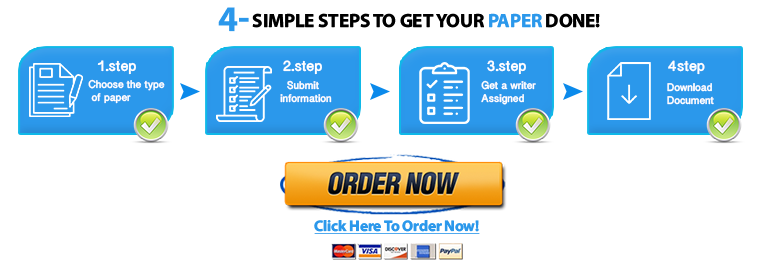

For best quality essays, written from scratch, delivered on time, at affordable rates!

ORDER NOW

Among other benefits, we guarantee:

Essays written from scratch – 100% original,

Timely delivery,

Competitive prices and excellent quality,

24/7 customer support,

Priority on customer’s privacy,

Unlimited free revisions upon request, and

Plagiarism free work