Accounting and Financial Management 1B. Accounting and Financial Management 1B. You will need to refer to the annual report of Billabong International Ltd as well as Course Materials to answer the following questions: (1) Consider what needs to be performed for the company in order to recognise revenue in its main operating activities. What actions involve the greatest amount of work in the process? Where is the greatest uncertainty in the process? What are the possible ways of accounting for this uncertainty? At what point does the customer obtain the benefits and risks associated with the product or services? (400 words) (6 marks) (2) Conduct a cash flow analysis which addresses: (1,000 words) (12 marks, 2 marks each component) (i) Comment on the relationship between cash flows from operations and net income for the year of the statement and previous year. (ii) What were the most significant sources of cash from operating activities during the period covered by the statement? What percentage of total cash inflows do these sources represent? Answer the same question for the previous period. (iii) Was the cash from operations more than or less than dividends during the period covered by the statement and the previous period? (iv) What were the firm’s major investing activities during the period covered by the statement and the previous period? Were cash flows from operations more or less than cash flows from investing activities? (v) What were the most significant cash flows from financing activities during the year of the statement and the previous year? (vi) Review the management discussion and analysis sections of the financial statements to determine if any additional information is available concerning the company’s investment or financing strategy. (3) Determine what stage of the lifecycle the company is within and provide a discussion with reference to the relevant figures to support your case – comment on operating, investing and financing cash flows. Discuss whether the company has the ability to undertake expansion with supporting calculations (700 words) (7 marks). Questions need to be addressed in assignment: Topic 3 – 1. What types of share capital does the company you have selected for the assignments have? Where there any issues of shares or buybacks during the period for your selected company? 2. Examine the balance sheet and notes of the company you have selected for the assignments, what types of reserve accounts do they have? 3. What would be the critical event for the revenue recognition of the company you have selected for the assignments?

4. Is percentage of completion used for the company you have selected for the assignments? What industries would you expect this method to be used within? Topic 4 – 1. Examine the cash flow statement of the company you have selected, consider what are the primary cash flows of the company that will regularly occur 2. Has the company you have selected for the assignments reporting on the face of the cash flow statement in the direct or indirect method? What differences between the two methods can you observe?) 3. What lifecycle stage most closely matches with the company you have selected for the assignments?

p(4s)

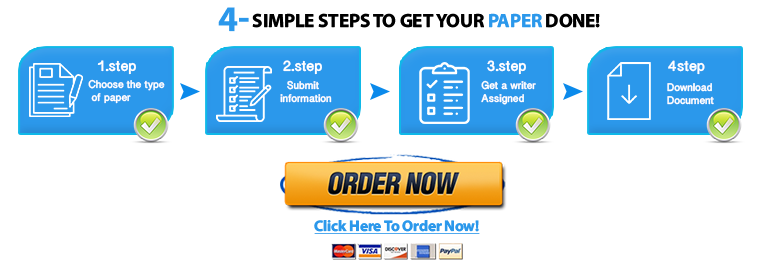

Place your order now to enjoy great discounts on this or a similar topic.

People choose us because we provide:

Essays written from scratch, 100% original,

Delivery within deadlines,

Competitive prices and excellent quality,

24/7 customer support,

Priority on their privacy,

Unlimited free revisions upon request, and

Plagiarism free work,